Protect Yourself From Bank Fees

One of your first routes that most likely come in your thoughts is utilizing a bank managed funds. In any cases, you simply need the recipient's name, bank name, and bank account number. So as to send money to USA states as apposed to yours, and the recipient is the friend or family member, this should not be a problem. In fact, you can perform the transaction online in many. This is called a wire transfer, and you can expect a fee of anywhere from $10 to $30. For example, Bank of America charges $25 for domestic wires.

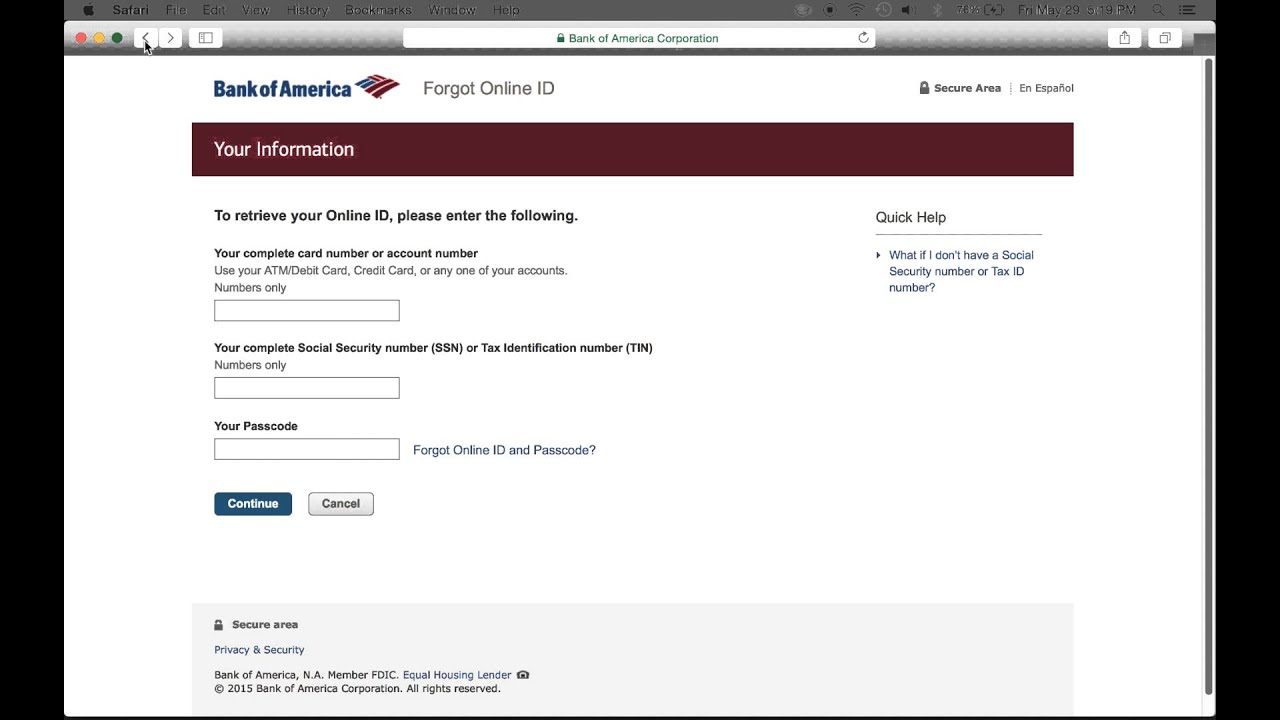

There are so many that it's hard to figure out which one is the hands down best. But having said that, some are improved than bank of america online banking other brands. Here is without doubt one of the best.

But another online bank may can make you yodel, "yahooo" a person have glance at their annual percentage yield. Internet bank Emigrant Direct offers 3.50% APY on its savings financial records. What does your big commercial bank together with? 0.50%? At that rate, you're not earning enough to beat inflation. Maybe it's time you joined the online market place age?

Partnership. Sort of customers are common whether your business requires you to take on a working partner for expert knowledge or financial needs. A partnership is often a legal associated with your business relationship and defines which party is critical to what aspect of the business.

Chase a person may know, recently bought up Wa Mu who had previously bought out Providian. My wife's original card was a Providian card which she opened six years within the past. In those six years she never missed a payment. You know what. The first line Chase support person did not know that. Everything that was in the computer was the brief history away from the time Wa Mu purchased Providian towards the time Chase acquired Wa Mu. In other words these people ignoring roughly five connected with her credit file.

Think twice before consider cash away from your credit chip. Credit card companies tend to encourage you to employ the advance loan service by sending your checks, providing you an ATM PIN. But ezcash do that unless you haven't any other choice, cash advance fee rrs extremely high.

Many community banks created lot of real estate loans subject to the indisputable fact that 1) they "ain't coming to a more house!" and 2) real estate values had historically more. In the fall of 2008, the regulators decided that real estate loans were bad and proceeded to force these community banks give up making industry loans and then write in the loans they already had.

Since 2000 I've been utilizing AmericanBank E-Checking (don't confuse this with Bank of America) as my main checking checking account. Back then they paid over 7% in interest! Now interest rates are depressingly low, no, they are pathetic virtually! But thanks to our fiscal policy, inflation is probably gonna rise and interest rates on savings and checking accounts will, hopefully, soon follow.